Introducing the My Continuum Wealth Managed Portfolios

A Managed Portfolio Service (MPS)

built on investment excellence

-

1

What we offer

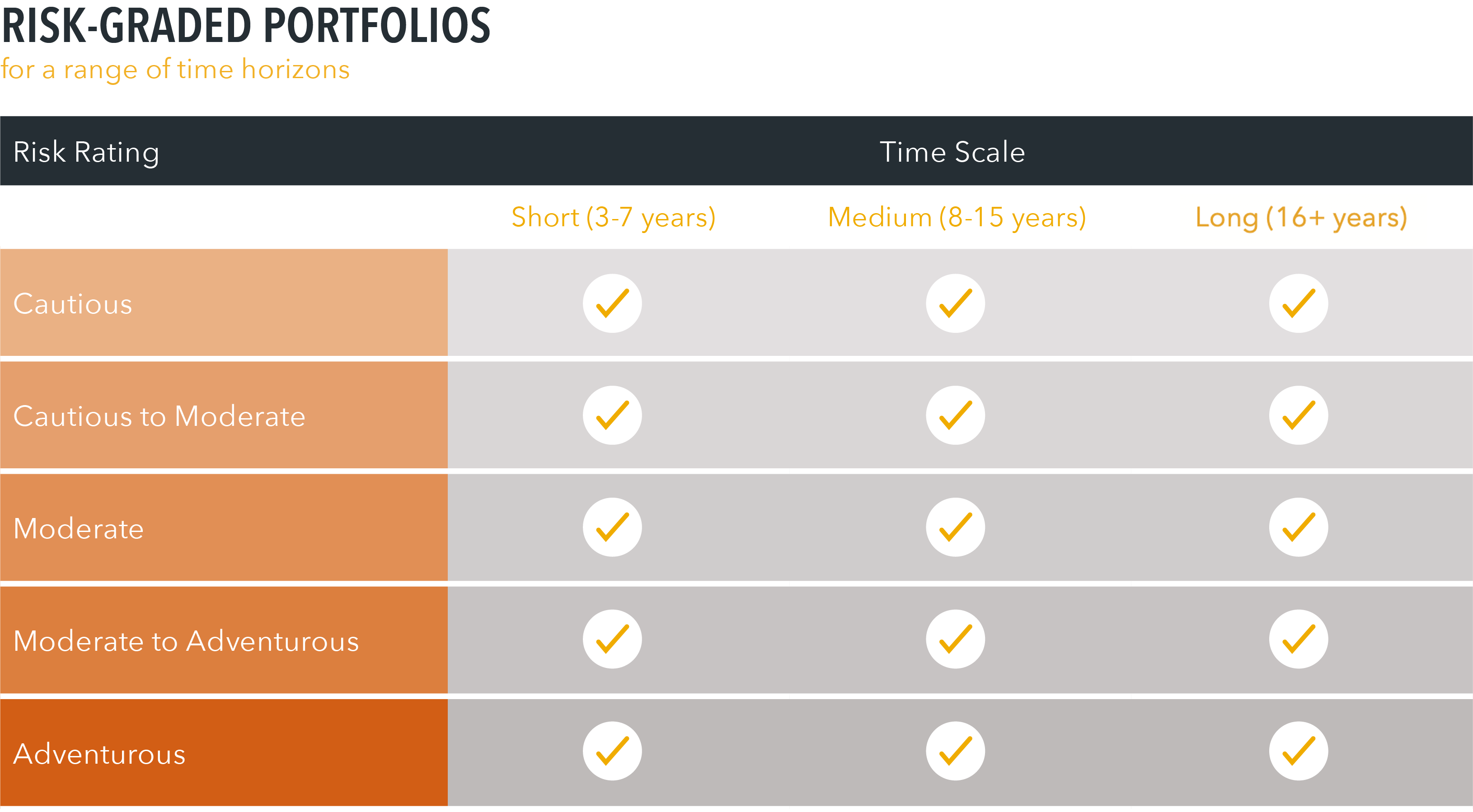

My Continuum Wealth offers a range of risk-graded portfolios, each designed to align to your chosen risk category.

The managed portfolios are constructed using pooled investment funds (sometimes known as unit trusts), with no direct investment in individual equities.

-

2

How they work

These funds provide diversified access to a range of global asset classes, which helps to manage risk and increases the range of investment opportunities available.

The Investment Team have earned a reputation for investment excellence and the portfolio managers have access to the expertise of award-winning specialist fund managers focusing on a range of asset classes, including UK equities, overseas equities and bonds.

-

3

What you can get

As an investor, you have access to a bespoke range of portfolios created exclusively for clients of Continuum (Financial Services) LLP.

These portfolios comprise of actively managed funds, passive funds or a blend of the two.

Why choose an MPS?

MY CONTINUUM WEALTH

Investment Expertise

To make the most of your wealth you need an investment management solution that helps you to achieve your future financial goals.

My Continuum Wealth help you do just that. We partner with Investment Management experts to build a range of managed portfolios, giving you affordable access to professional investment management.

We have chosen to work with M&G Wealth Investments LLP, with the aim of delivering high quality well managed investment solutions for you. M&G Wealth Investments is part of M&G plc, which is an international savings and investments business. We take responsibility for the regular monitoring of their performance.

CREATING

your investment solution

The aim of the My Continuum Wealth investment team is to deliver the best possible return for the level of risk you wish to take. To do this they employ a rigorous and disciplined investment process.

Your risk profile will be determined by using the FE Analytics attitude to risk questionnaire, in conjunction with your financial adviser. This will measure your attitude to risk and Investment time horizon.

The My Continuum Wealth investment team have created a range of managed portfolios to match each FE risk category and time horizon. They use a range of pooled investment funds which give indirect exposure to a range of assets including equities and bonds and combine these together so that the more risk the investor is prepared to take (as categorised in the table below), the greater the potential return (although losses are always possible). This combination of assets is called the asset allocation.

POWERING

your investment portfolio

Once the asset allocation has been determined, the investment management team will select the funds to construct the Managed Portfolios.

The selection of these funds will reflect the asset allocation, while also ensuring that the integrity of the risk category is maintained and maximised so the best potential return for that level of risk is achieved.

The investment team have many years’ experience selecting the most appropriate funds for portfolios and use a combination of data analysis, in-depth market knowledge and an understanding of the characteristics of different funds to select the very best options.

The first step is to analyse a wide range of information drawn from databases covering the whole of the UK market. This will allow the investment team to study funds from a number of perspectives, including consistency of performance and the level of risk taken in achieving those returns.

The process will significantly narrow down the number of funds considered.

The next step is to engage with the management team running a fund so they can understand every aspect of their investment style and philosophy. This will allow the investment team to understand how the fund is likely to perform in a range of market conditions and how the underlying fund management team plan to consistently maintain the fund’s objectives.

The final stage is to combine the funds together to seek to ensure that the portfolio risk category objectives are met over the short, medium and long term.

The My Continuum Wealth investment team will seek to ensure that there is sufficient diversification to provide the best return for the level of risk being taken.

Risk Warning

All Model Portfolio investing carries risk and returns are not guaranteed.

Risk Warning

All Model Portfolio investing carries risk and returns are not guaranteed.

ABOUT

the investment manager

The portfolios are managed by M&G Wealth Investments LLP, which is part of M&G plc. M&G plc is an international savings and investments business, managing money for around 5 million retail customers and more than 800 institutional clients in 28 markets.

M&G Wealth Investments LLP constructs the models and manages them on an ongoing basis. The investment team is supported by M&G’s Treasury & Investment Office (T&IO), which completes due diligence on funds. T&IO are an independent investment team within M&G plc that focus on multi-asset investing. They leverage the wider group resources, which includes M&G Investments, M&G Real Estate and M&G Alternatives.

SELECTING

your investment options

As well as providing a robust and disciplined approach to creating your investment solution, the My Continuum Wealth Managed Portfolio Service offers three investment management styles to suit your preferences.

The decision about which is the best option for your portfolio should be made in conjunction with your financial adviser. They will look to understand which investment approach you are comfortable with and which best meets your investment objectives.

In broad terms, assets can be managed in two different styles with the full range of options set out below.

MY CONTINUUM WEALTH

ongoing review process

The robust and disciplined My Continuum Wealth investment process constantly monitors and reviews every aspect of the portfolios and the underlying funds to seek to ensure the investment objectives are achieved through different market conditions. The process is overseen by a formal committee that considers the interests of investors.

Once the portfolio has been created, it will contain a number of funds that will have been carefully blended to produce the best return for the risk category to which it is aligned. We seek to ensure that the asset allocation continues to maximise the return for the level of risk taken and that the underlying funds, and the way they are combined, delivers the best possible investment return.

The My Continuum Wealth Investment Committee meets regularly to conduct independent oversight and review of the management of all portfolios

SUMMARY

of our service

What is available

The exclusive My Continuum Wealth Managed Portfolio Service provides a comprehensive approach to managing your investments.

This means it can be a simpler, more cost-effective investment solution with diversified exposure to a range of global asset classes.

This complete service offers:

What it delivers

As an investor, you will benefit from the experience and expertise of the My Continuum Wealth investment team and their disciplined and robust investment process, which incorporates institutional-level analysis.

They will:

THIS MANAGED PORTFOLIO SERVICE IS AVAILABLE THROUGH CONTINUUM (FINANCIAL SERVICES) LLP.

PLEASE CONTACT YOUR CONTINUUM ADVISER, CALL 0345 643 0770 OR EMAIL INFO@MYCONTINUUMWEALTH.CO.UK

FOR MORE INFORMATION

Please contact your Continuum adviser, call 0345 643 0770 or email info@mycontinuumwealth.co.uk